Dispersion Matters -Is Breadth A Risk For The Stock Market?

Understand why dispersion has an impact on breadth and the stock market.

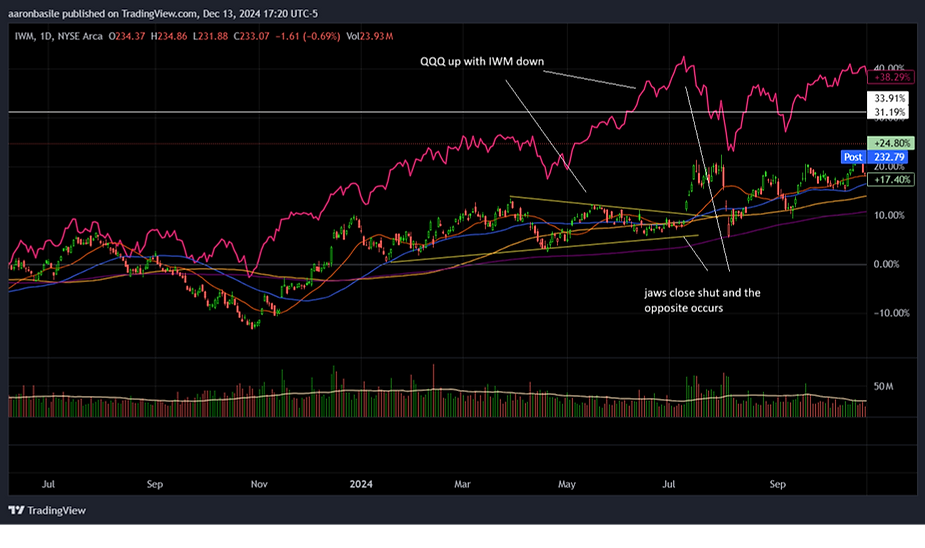

Recently the stock market has made new all time highs, particularly in technology (QQQ, XLK). Many analysts are crying foul however. Market breadth has dropped substantially as only a small handful of stocks have carried us to new highs such as stocks like AAPL, AVGO, and TSLA. This complaint comes from a major lack of understanding of how dispersion can effect the indexes. When dispersion levels are low, lack of breadth CAN be a potential warning sign of declining momentum & distribution, however current levels are actually even lower than they were 2017, and even more so than mid-summer.

Dispersion is what happens when volatility becomes pinned at the index level - meaning dealers are hedged very well for tail events, which imposes a pinning effect on the market. IE If the index is pinned and X amounts of stocks are up 0.50% for that day, than an equal amount of stocks need to be down the exact amount to offset that. Again, its a major reason as to why the breadth was so poor today (159 advancers vs. 359 decliners) as now trillion dollar stock Broadcom (AVGO) gained 24.43% on the session. A stock with that market cap being up that much on the day means that a TON of other stocks need to be down in order to offset the gain. As such, stocks closed flat to mixed on the day. This mistake caused investors to be short the market during the early to mid summer which subsequently made them miss of the big trades of the year which was long small caps (IWM) into July CPI.

Understanding this dynamic can prove wildly profitable as members of Carnivore Trades posted major gains as a result of this move. In short, market breadth is a tool like anything else however it is paramount to understand the why behind movements in the market otherwise you may find yourself on the wrong side of the trade. To get the full analysis with specific levels & dates where the market will put in the next tradeable pivot low, join us at account.carnivoretrades.com for exclusive access & membership plans.

Youtube - @carnivoretrades

X - @aaronbasile

Instagram - @carnivoretrades

Substack - @carnivoreaaron